Social Security, along with Medicare, is one of the most common government benefits offered in the US. And yet, many people don’t know much about it.

In fact, one of the biggest questions I get is regardless of how much clients have in retirement savings is: “When should I start taking Social Security?” We’ll cover that in this article, along with some of the basics to help you understand how we think about Social Security.

What is Social Security?

A news article announcing the passage of Social Security in 1935 called it “a great national annuity system.” Essentially, Social Security is intended to provide income to Americans in old age. Or, as the news story puts it, when they’re “65 and jobless.”

This has changed slightly over the years. To start, you can collect Social Security even if you have a job. And you can begin collecting benefits at age 62, though the amount you collect will be less than if you wait until your full retirement age.

What your full retirement age is depends on the year you were born. For instance, if you were born in 1955, your full retirement age is 66 and two months. If you wait to collect Social Security, the amount you can collect increases until you hit age 70.

If you’ve heard any political debate in the last 20 years, you may also wonder how Social Security is funded. It’s paid for in large part by a tax on workers and employers. In 2022, that tax rate is 6.2 percent for employers and 6.2 percent for employees.

How much will my Social Security benefits be?

The way Social Security benefits are calculated is famously complex and depends on a variety of factors, so the easiest way to understand them may be to sit down and talk through your personal situation. But here’s an overview.

We recognize the complexities of Social Security and hired a specialist who worked for the Social Security Administration (SSA) for 35 years. Each of our clients does an individual consultation on their personal situation. For instance, going back to the initial question — When should I start collecting Social Security — personal circumstances matter a great deal.

Most resources on the internet will tell you to wait as long as possible — waiting longer increases the amount of your benefits checks. But if you’re married with children, you might want to start collecting your benefits early in an attempt to preserve as much of your nest egg as possible, so you can pass it on to your children. Remember: You can’t bequeath your Social Security benefits to your children, but you can pass your retirement account to them.

If you’re single with no heirs, however, you might want to wait as long as you can in order to get bigger payments. For many, Social Security is a big part of their retirement income and is an important part of cash flow. But the benefit is only designed to replace a portion of your pre-retirement income. (More on that later.)

That said, taking full advantage of Social Security, and using it strategically, can take the pressure off the rest of your portfolio to generate income. Plus, you paid into the benefit pool during your working years, so taking the best possible advantage of that money in retirement makes sense.

How Social Security Benefits are calculated

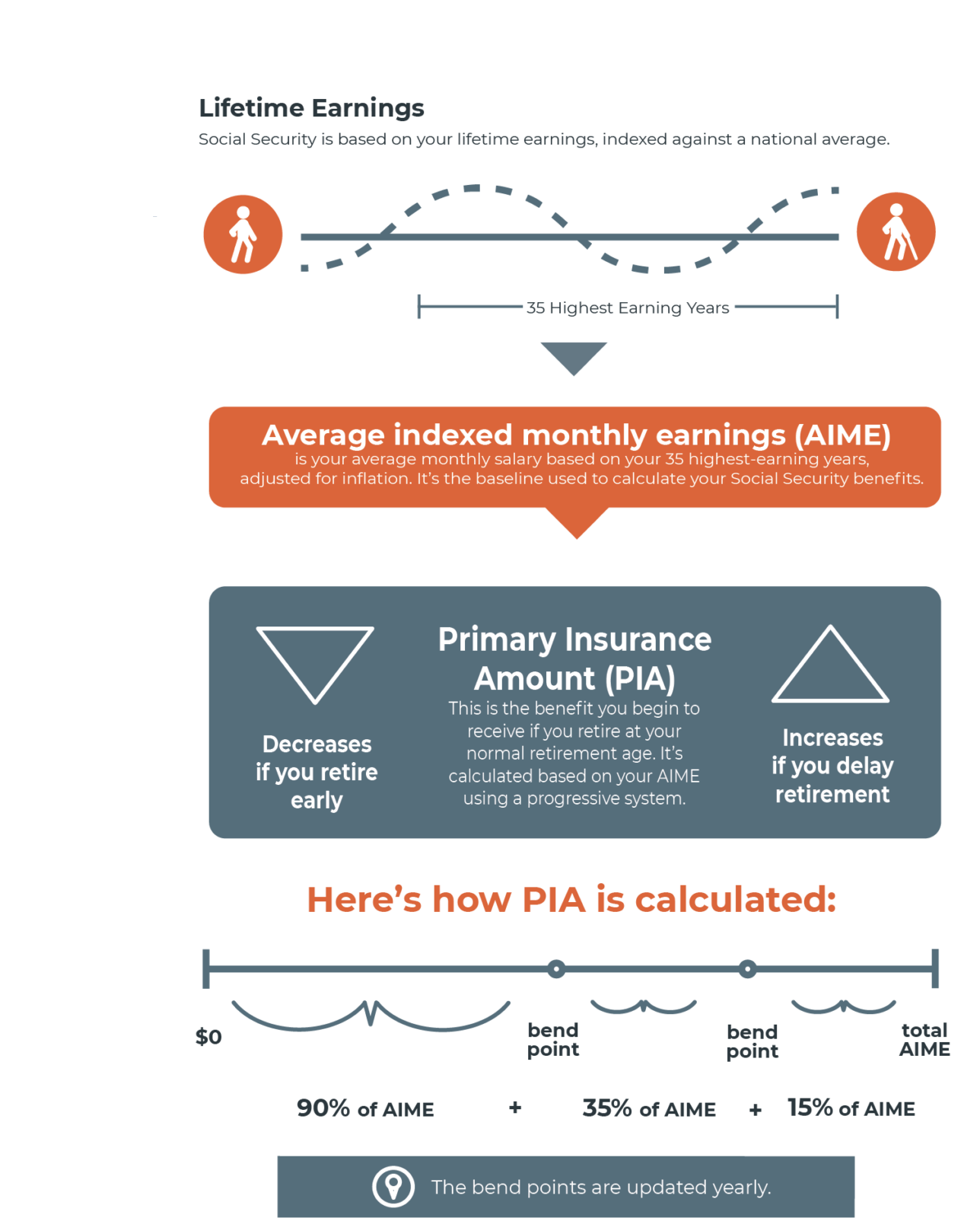

This might be easier to see visually, so we’re including a graphic here that breaks down the way these calculations work. But we’re also going to talk you through it. Essentially, your benefits are based on your lifetime earnings. The SSA adjusts (or indexes) your lifetime earnings against a national average. Then they zero in on the 35 years where you earned the most money and come up with a monthly average for that window. This is known as your Average Indexed Monthly Earnings (AIME), a term you may see referenced if you ever start reading up on benefits.

The goal of calculating your AIME is, essentially, to adjust your wages for inflation and put the average into today’s dollars.

SSA then uses AIME as the basis for figuring out your Primary Insurance Amount (PIA). Social Security is progressive, meaning it is meant to replace a larger amount of income for lower-salaried workers than higher salaries. So up until a certain amount (called a bend point), you receive 90 percent of your AIME. Up to the next bend point, you receive 32 percent. And after the third bend point, 15 percent.

Your primary insurance amount is a key metric but (and this is part of why the calculations are famously complex) it’s not the final amount you’ll receive. The number is adjusted for inflation using a cost of living adjustment (COLA). In 2022, this number is 5.9 percent. So your PIA in 2020 would be adjusted up by 1.6 percent.

Your PIA represents your benefits at full retirement age. If you begin collecting Social Security early, you’ll receive just a percentage of your PIA. If you delay retirement, the increase in your benefits will be calculated based on your PIA, too.

Source: Retirement Benefits, SSA, 2020. Benefit calculations, SSA.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.